WeChat Pay vs Alipay 🥊 Which One is Better? 2023 Edition

WeChat Pay vs Alipay // Find Which One is Right For You

Welcome to the battle of two heavy weights, WeChat Pay vs Alipay.

Today we’re going to tell you everything you need to know about China’s leading mobile payment systems.

In recent years China has been moving towards a cashless society. This has been made possible by two smart payment giants: WeChat Pay and Alipay.

Mobile payments now dominate the market in China, which can sometimes be a bit confusing for foreigners who are unfamiliar with the systems.

That’s why we’re going to take a closer look at WeChat Pay and Alipay to see what the difference between the two actually is.

WeChat Pay vs Alipay || Quick Introduction

WeChat Pay vs Alipay || What’s the Difference?

WeChat Pay vs Alipay || What Can they be Used For?

WeChat Pay vs Alipay || Which One is More Popular?

WeChat Pay vs Alipay || Can You Link a Foreign Bank Card?

WeChat Pay vs Alipay || Can You Use them Outside China?

WeChat Pay vs Alipay || Summary

WeChat Pay vs Alipay || 2023 Updates

WeChat Pay vs Alipay || FAQs

WeChat Pay vs Alipay || Quick Introduction

First of all, let’s start with a quick introduction to these two mobile payment platforms, that are used in over 90% of cashless transactions.

WeChat Pay

WeChat Pay was developed as an additional feature within China’s must have instant messaging and social media app WeChat.

WeChat is owned by Tencent and is China’s most popular messaging app, although it has now become far more than that.

WeChat started as a chat app when it was launched in 2011, but has now become much more than that.

In 2013 WeChat’s virtual wallet payment system WeChat Pay (also referred to as TenPay) was introduced.

Although WeChat Pay is much newer than its main competitor Alipay, its already huge user base has enabled it to quickly become dominant in the market.

WANT TO DISCOVER MORE – Check out our guide on how to use WeChat here.

Alipay

Alipay is owned by e-commerce giant Alibaba.

It was first introduced in 2003 as an online digital payments solution for the Alibaba website.

In 2008, Alipay officially introduced its mobile e-wallet and has become a regular payment facility that services not only Alibaba products.

Before WeChat Pay was introduced Alipay completely dominated the smart and mobile payment market within China.

WeChat Pay vs Alipay || What’s The Difference?

The main difference between WeChat Pay and Alipay is that WeChat Pay is an in-app feature of the social media app WeChat whereas Alipay is a dedicated smart and mobile payment system.

This means that although both systems can be used for similar things the focus of them is slightly different.

WeChat Pay is more of a social app used by most users to navigate their daily life.

Popular uses are purchasing groceries, paying bills, transferring money to friends, sending red envelopes and other everyday transactions.

Alipay on the other hand puts more emphasis on e-commerce payment and financial services. As Alipay was originally created as a payment platform for the Alibaba website, it has become more of an escrow payment service.

In the table below you can see some of the key differences between the two smart payment systems.

| WeChat Pay | Alipay | |

|---|---|---|

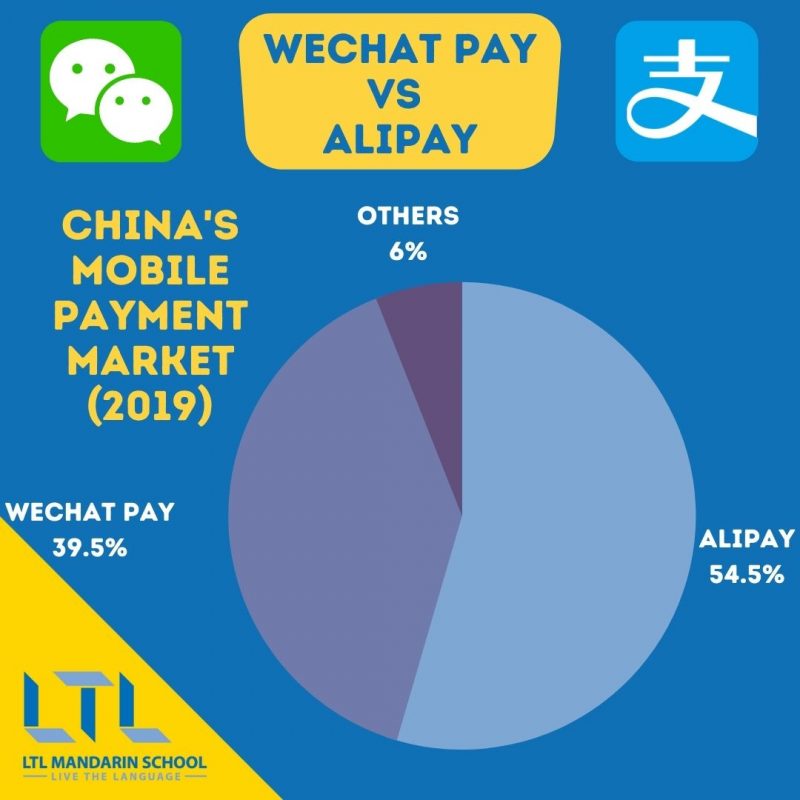

| Share of China’s mobile payment market | 39.5% | 54.5% |

| Market penetration rate | 84.3% | 62.6% |

| Number of supported currencies | 13 | 27 |

| User Fees | 0.1% for withdrawals over RMB 1,000 | 0.1% for withdrawals over RMB 20,000 |

| Supported devices | Devices that support WeChat | All phones, tablets, and PCs |

With more supported currencies and a much higher limit for withdrawals, you can see some of the ways that Alipay is more focused towards ecommerce and business.

Living in Beijing Part 1 | Being a Beijing Expat 🌎 What’s the Deal?

Beijing is an incredibly large city, and because of this looking for apartments and getting prepared for living in Beijing can be extremely daunting.

WeChat Pay vs Alipay || What Can They Be Used For?

Almost everything.

Yes, nowadays WeChat Pay and Alipay can be used for pretty much everything.

Whether it’s ordering food, getting a taxi, topping up your electricity, buying plane tickets or sending money to friends the sky really is the limit with these mobile payment apps.

In fact, there are now some shops and venues which only accept mobile payments.

| Usage | WeChat Pay | Alipay |

|---|---|---|

| In-store | Yes | Yes |

| Online | Yes | Yes |

| Didi | Yes | Yes |

| Food delivery | Yes | Yes |

| Taobao | No | Yes |

| TMall | No | Yes |

| JD (Jing Dong) | Yes | No |

| Transfers | Yes | Yes |

| Red Envelopes | Yes | Yes |

| Bills | Yes | Yes |

| Train/plane Tickets | Yes | Yes |

| Bike sharing apps | Yes | Yes |

You’ll see that the only usage Alipay has which WeChat Pay doesn’t is the shopping apps Taobao and TMall.

This is because they are both owned by Alibaba so it makes sense for their business not to allow their competitor WeChat Pay as an option on their shopping apps.

Similarly, thanks to a deal in 2015 between Tencent and Jing Dong, you are only able to use WeChat Pay as a mobile payment on JD. You are also able to directly access JD through the WeChat app.

JD is not the only app you can access thorugh WeChat.

In fact, WeChat actually has a lot of partnerships set up with other Chinese companies which allow you to directly access them as a Mini Program.

Some other available apps are:

- Didi

- Dianping/Waimai

- Tongcheng-eLong (travel app)

The Alipay app also allows users to use in app third party services such as:

- Eleme

- Taobao

- Hellobike

HOW TO – Order Food in China 🤔 Best Food Delivery Apps in China

How to Order Food in China (in 2021) // The Best Apps (& Tips)

WeChat Pay vs Alipay || Which One is More Popular?

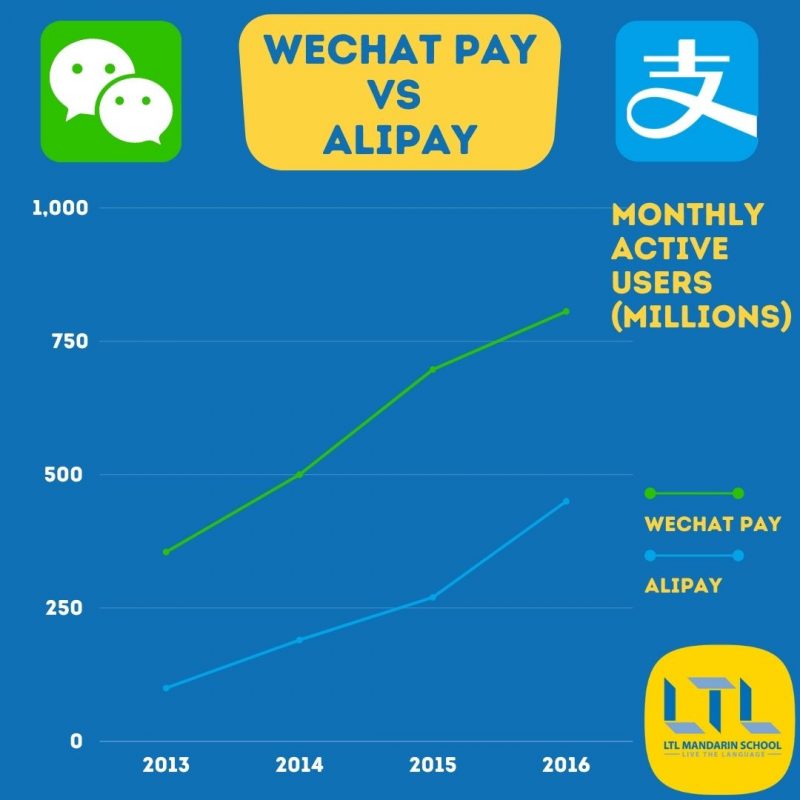

Given the fact that almost everyone in China uses WeChat it’s no surprise that WeChat Pay now has more monthly active users than Alipay.

Although year on year users of both smart payment systems have been growing, the most recent data shows that WeChat Pay has more user.

For normal, everyday users, it does make more sense to use WeChat Pay as pretty much everyone will already have WeChat it’s much easier to use the in app feature and simply add your bank details rather than download a separate app.

To take myself as an example when I first moved to Beijing for the first few months, I exclusively used WeChat Pay. It wasn’t until I wanted to use Taobao that I then also set up an Alipay account.

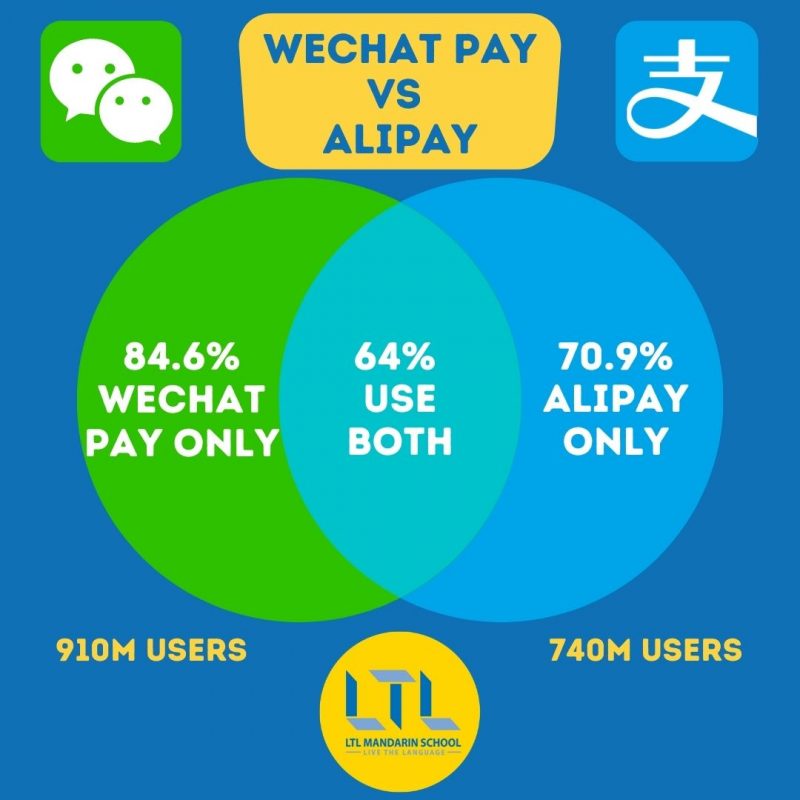

As you can see in the Venn diagram below it is quite common for users to use both WeChat Pay and Alipay.

However, although WeChat Pay has more monthly active users, Alipay is still the most popular online payment system in China.

In Q3 of 2019 Alipay had over a 50% share of China’s mobile payment market with 54.5%. Whereas WeChat Pay had 39.5%.

This also clearly shows how the two smart payment giants dominate the market, accounting for a total of 94% share between them.

But could this all be set to change with the massive growth WeChat Pay has seen over the past few years?

As recently as 2014 AliPay accounted for over 80% of transaction value in the mobile payment market and WeChat Pay only 10%. Given, this it’s pretty impressive that in just five years WeChat Pay has grown to almost 40%.

WeChat Pay vs Alipay || Can You Link a Foreign Bank Card?

Yes, as of November 2019 both WeChat Pay and Alipay enabled users to link a foreign bank card to their account for the first time.

Alipay was the first to introduce this, creating an international e-wallet, targeted at tourists, that allowed foreign bank cards to be linked to the app.

Never one to fall behind, WeChat Pay soon followed suit and also made adding foreign bank cards available on their app.

And then, in 2023, Alipay and WeChat announced that they would be allowing tourists and short-term visitors to link their international cards rather than just long-term residents.

However, the way the two work differs quite significantly.

With Alipay users can top up an e-wallet called a “Tour Card” using their foreign bank card, this is limited to a maximum top of 10,000 CNY and can only be used for 6 months.

You can see full details in our guide to using Alipay as a foreigner and WeChat Pay for Foreigners.

In contrast WeChat Pay has enabled users to make payments directly through its digital wallet using the linked foreign bank card. It’s important to note that only credit cards can be used, although you can enter the details of a debit card it won’t work.

Also if your WeChat Pay is linked to a foreign bank card, the uses of it are more limited.

For instance you can pay vendors, but can’t make transfers to friends or send red envelopes.

Whereas using the “Tour Card” in Alipay gives you access to all of the Alipay features.

Alipay for Foreigners || Big News for 2023 (How To Link Your Bank Card)

Using Alipay in China || You can now link your foreign bank to Alipay to pay for things in China. Follow this step-by-step guide to find out how.

WeChat Pay vs Alipay || Can You Use Them Outside China?

Although more and more countries are accepting WeChat Pay and Alipay as payment methods outside of China this is only available to Chinese citizens.

Currently, to be able to use Alipay or Wechat Pay abroad you need to have an account with a mainland Chinese ID.

This is disappointing for foreigners who live in mainland China and then go to a neighbouring country on holiday.

However, with the changes in 2019 to allow foreign bank cards to be added to the apps perhaps it won’t be too long before foreigners can use these smart payment systems outside of China.

China Travel Tips – 20 China Hacks You Must Know

20 China Travel Hacks to Make Your Time in China Super Smooth Need some China travel tips, tricks and hacks to help get by in China? If you’re new around here these China hacks are about to become very helpful!…

WeChat Pay vs Alipay || Summary

Overall the difference between the two apps is very little.

Both apps can be used for almost all payments and transactions needed in daily life.

If you are new to mobile payments in China and want to know which one to go with, WeChat perhaps makes more sense.

As WeChat is already an essential app for living in China, it makes sense to make use of the WeChat Pay rather than downloading a separate app.

However, if you want to experience the wonderful world of Taobao shopping you will need to download Alipay.

For anyone who will only be in China short term and wants to link a foreign card it may be worth downloading Alipay and using their Tour Card as this has more features than adding a foreign bank card to WeChat Pay.

WeChat Pay vs Alipay || 2023 Updates

Apps are changing all the time (looking at you, Twitter), but luckily we’re here to keep you up-to-date on the latest and most important updates of the year.

Alipay

- Visitors to China are now able to link both Mastercard and Visa cards to Alipay and use this as they would normally to pay for goods and transport (and yes, that includes the subway!)

- TourPass has now been upgraded to Tour Card, which you allows you to preload you Alipay account. Check out our Alipay Guide for more information

WeChat Pay

- Like Alipay, WeChat Pay can now link both Mastercard and Visa cards as a form of payment.

- Digital Yuan, or e-CNY, is now being rolled out across China and can be used on WeChat Pay for anything from ordering a cheeseburger to paying your bills.

- Soon, you might not even need your phone at all! This year WeChat Pay introduced Palm Payment, which yep, literally means scanning your palm to make a payment.

WeChat Pay vs Alipay || FAQs

What is the difference between WeChat Pay and Alipay?

WeChat Pay and Alipay can both be used for almost all of the same things, however, the main difference between WeChat Pay and Alipay is that WeChat Pay is an in app feature of the social media app WeChat whereas Alipay is a dedicated smart and mobile payment system.

WeChat Pay is more of a social app which is used to navigate daily tasks, whereas Alipay is more focused towards e-commerce and financial products.

Can WeChat transfer money to Alipay?

Yes, you can transfer money from WeChat Pay to Alipay. However, this feature only works if you have a Chinese bank account.

Can you use WeChat Pay without a Chinese bank account?

Yes, as of November 2019 you can now get WeChat Pay without a Chinese bank account.

You are now able to add a foreign credit card to WeChat Pay, however this does restrict what you can use WeChat Pay for.

Can you use Alipay without Chinese bank account?

Yes, you can now use Alipay without a Chinese bank account.

Foreigners without a Chinese bank account can top up an e-wallet called a “Tour Card” using their foreign bank card. As of 2023, you can also link international cards to your account.

Read our full guide on Alipay for foreigners.

Can I use WeChat Pay in China?

Yes anyone can use WeChat Pay in China.

You can link your Chinese bank account, or if you don’t have one you can now link a foreign credit card.

Can foreigners use Alipay outside China?

No, currently only mainland Chinese citizens with a Chinese ID number are able to use Alipay outside of China.

Want more from LTL?

If you wish to hear more from LTL Mandarin School why not join our mailing list.

Sign up below and become part of our ever growing community.

WANT TO STUDY CHINESE FREE FOR A WEEK? Check out Flexi Classes and get 7 days for free.

We’ve got the best teachers, from the comfort of your own home!

BONUS | Want to learn Chinese in China? Check out our lessons in Beijing.

![[𝗢𝗟𝗗] LTL Beijing Logo](https://old.ltl-beijing.com/wp-content/uploads/logo-ltl-header.png)

Hi, my name is Sabatino! I am from Italy and I am a Student Advisor at LTL. Fancy coming to study with us in China? Drop me a message.

Hi, my name is Sabatino! I am from Italy and I am a Student Advisor at LTL. Fancy coming to study with us in China? Drop me a message.

18 comments

I’m hoping to go to China next year to study, would I be able to get wechat pay or alipay set up before I go??

Hi Ali,

You should be able to set up Alipay or WeChat Pay with a foreign bank card before you go. You can see our blog here about how to add a foreign bank card to Alipay. When you move to China you should also be able to set up a Chinese bank account and then will be able to link this as well. Hope that helps!

LTL

[…] WeChat Pay or Alipay topped up with money, easiest way to pay for things. **If you don’t have a Chinese bank account look at how to use Alipay for foreigners. […]

Thank you for the nice summary! I have two questions: 1) Do you need to have WI-FI or access to the internet when you use Alipay? 2) The amount allowed is 2,000 RMB for 3 months for Alipay? Once you use up the 2,000 RMB in one day, can you add another 2,000 RMB the next day? What is the limit for topping off in the 3 months period?

Thanks!

HI Cheryl,

Thanks for your comment, let’s help you out here:

1 – You do need Wifi or Data access but what I found before is that if you have the QR code up before, have no internet, but use the code, it did work also. This could be a solution if you don’t have any data. But if you wanted to load up Alipay from the start, with no data, it won’t work.

2 – The Alipay tourpass allows 2,000RMB yes. We aren’t sure of the exact limit for Tourpass but you can definitely top it up again. Remember this is Tourpass, if you have a Chinese bank account linked to your Alipay or WeChat you can spend as much as you have!

Hope this helps

LTL

Major thanks for the article. Really thank you! Cool. Rorie Zollie Thomsen

Thanks Rorie!

The LTL Team

[…] You might already have heard of some of these Chinese traditions such as red envelopes (红包 hóngbāo) which have become such a part of everyday life you can send them on WeChat Pay and Alipay. […]

[…] forget to bring cash with you, you can pay with WeChat, but that requires some Chinese-language […]

[…] WeChat and AliPay have always had one shortcoming for foreigners and it’s actually incredibly relevant to a lot of our students here at LTL Mandarin School. […]

[…] Beijing a mini-program run through WeChat or AliPay is used which is called the Health Kit or 健康宝 jiànkāng bǎo in Chinese. You fill in your […]

To be frank I am unable to use any VISA credit card in Wechat (both for topping up and as direct payment). For the latter I am able to add the card but it not accepted for use online… I am not sure if this works for you now… if so let me know how…

Interesting feedback, thanks for the comment Matteo! It can really vary depending on the card annoyingly.

[…] nuovo servizio, indirizzato per lo più a turisti stranieri. La piattaforma ha infatti creato un e-wallet chiamato Tour Pass, con un tetto massimo di 2000 CNY, che può essere utilizzato fino a novanta […]

3 months Alipay vs credit cards only Wechat… UGH! For those of us retired and living here, and only having foreign checking account debit Mastercard, neither are longterm solutions. Along with restrictons on opening new bank accounts in China (at least in Shenzhen), its nearly if not completely impossible to link the two at this time. Hopefully this changes because the high fee based workarounds add up very quickly. All the same, thanks for the info.!

Hello, Would you mind sharing your sources for these numbers and stats please?

We took them from a WeChat article when we wrote the article in 2020.

[…] en China desde comienzos de la década pasada con WeChat Pay y Alipay; de hecho se pueden encontrar muy buenas comparaciones entre ambas aplicaciones que permiten entender su alcance en esa parte del […]